MOQ (minimum order quantity): striking a balance

How many items do I need to purchase for the supplier to fill the order? Minimum order quantity or MOQ is a widespread concept that’s very much present in the age of e-commerce. Globalization compels companies to rely on international suppliers with which they reach agreements for specific minimum sales amounts.

In this post, we’ll do a deep dive into the MOQ concept, the factors that affect it, how to calculate it, and how to reduce the minimum product quantities set by suppliers.

MOQ: what is it and why is it used?

The minimum order quantity or MOQ refers to the very least number of units of a product that a supplier is willing to sell.

Why do suppliers work with MOQs? It’s very simple: the minimum order quantity is the only guarantee they have to cover the costs of production, labor and shipping (if included) and to generate a minimum amount of profit.

Factors that determine MOQ

The main element that defines this variable is the raw materials with which each supplier works, whether because of the total costs related to their extraction or processing or because they were bought from another supplier that has its own MOQ.

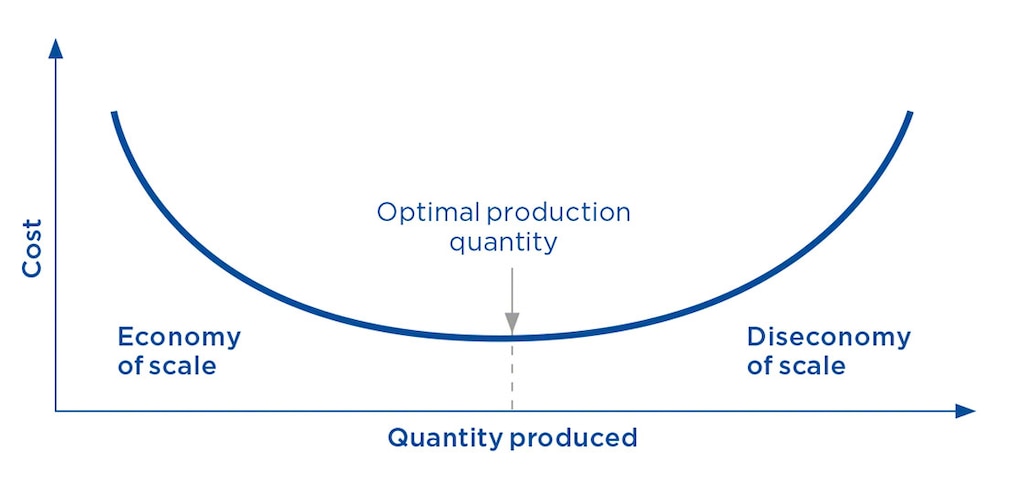

Production cost per unit is another factor directly related to minimum order quantity. Suppliers offer discounts in exchange for larger orders. This is the result of an economy of scale, whereby the supplier reduces its costs by increasing its production volume. The larger the volume, the higher the profit margin for the supplier (until reaching the optimal production amount); thus, its ability to give discounts will also increase.

Lastly, the MOQ is also influenced by each supplier’s business strategy. In other words, what profitability you want to obtain with each minimum order quantity, who your target customer is, and how you want to compete with other suppliers.

Impact of MOQ on inventory

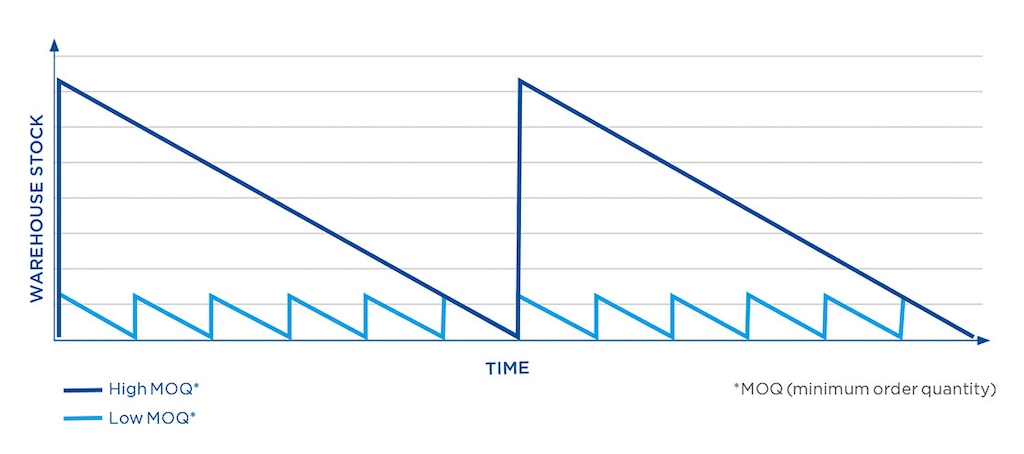

Order size affects warehouse stock. So, if a supplier sets a high MOQ, orders will be larger, and inventory fluctuations will be more marked. If the MOQ is low, on the other hand, these stock variations will be less accentuated. That’s to say, the MOQ has a considerable effect on the warehouse.

- High MOQ: when the MOQ is high, the supplier, in turn, needs to maintain a considerable stock of product in the warehouse. This involves increased investment in product acquisition and greater storage costs, as well as risks to goods (expiration dates and the like). However, if all goes well, sales profits could be bigger.

- Low MOQ: when a smaller MOQ is agreed upon, the supplier can maintain a lower level of SKUs in stock. This facilitates warehouse management and reduces the possibility of the goods becoming obsolete. Likewise, the initial investment in the product will be more modest, as will the storage costs. The drawback to working with low MOQs is the notable increase in goods replenishment and transportation tasks. Therefore, it’s essential that this work be managed efficiently to avoid stockouts. To do this, installations use warehouse management systems (WMSs), which enable them to establish replenishment methods in line with their logistics requirements.

High or low MOQ: which is better? The answer depends on the volume of units each business moves, in other words, its stock turnover in the installation.

Formula for determining MOQ as a supplier

It’s difficult to accurately assess the minimum amount a supplier should set, since a wide range of variables are involved.

Nevertheless, as a guide, we can calculate the MOQ based on the production cost per unit of product. To do so, we first have to calculate the total manufacturing costs and divide them by the number of items produced.

Total production cost = fixed costs (labor, leasing of premises, etc.) + variable costs (packaging, raw materials, etc.)

Cost per unit = total production costs (fixed cost + variable costs) / units produced

Then, we decide what profit margin we want to obtain for each unit sold and extrapolate that to the minimum order quantity.

Let’s take a look at an example for calculating MOQ. It costs a bolt manufacturer $1,000 to produce 20,000 bolts. In other words, each bolt costs $0.05. Let’s say the manufacturer wants a profit margin of 50% for each bolt sold. The minimum cost of each bolt, then, would be $0.075.

To define the minimum order quantity, several factors need to be considered, such as: What’s the competition’s MOQ? How many orders are received per day? And what’s the average volume of units requested by each customer? Imagine that this bolt manufacturer receives three orders a day, each with an average of 7,500 units.

The manufacturer — to ensure continued sales of those three daily orders and, in turn, cover those customers who want a smaller amount — could set a minimum order quantity of 7,000 units, amounting to $525 in total. Three orders at that MOQ and price would compensate the $1,000 spent on production and, at the same time, give the manufacturer its desired profit margin of 50%.

It’s important to note, though, that this example doesn’t take into account external product expenditure, (transportation, for instance), since each supplier decides whether to include that or charge it separately.

Advantages to establishing an MOQ

The main advantage of MOQs is that they let suppliers offset fixed production and labor costs, in addition to other expenses. MOQs are also useful for more reliably predicting sales volumes and, hence, estimated business profits.

From the buyer’s point of view, MOQs clearly constitute a constraint. But there’s also a positive side to them: they make it easy to compare prices. Suppliers with MOQs are usually more transparent, as they communicate discounts applied based on order volume.

Another plus is that MOQs create a long-term symbiosis between the supplier and purchaser. By ensuring a certain volume, the supplier can invest in and improve its production system. This results in improved product quality, which also benefits the customer.

Driving down the MOQ when you’re the customer

If you’re the customer, and you can’t take on the supplier’s MOQ, it’s time to sit down at the table. Your objective here is to minimize the minimum order quantity while maintaining a competitive unit price. Some suppliers agree to cut the MOQ with the aim of receiving larger orders in the future.

To negotiate the MOQ, it’s advisable to first request a sample from the supplier to check the quality of the product. If it isn’t up to snuff, you’ll avoid further outlays and can even use it as a bargaining tactic.

However, if a supplier does agree to reduce the minimum order quantity, it’s crucial to make sure the quality of the merchandise isn’t compromised. The supplier might attempt to make up for a lower MOQ by using raw materials of inferior quality to maximize the sale.

Finally, if a supplier just won’t budge on its MOQ, you can always offer to pay more per unit. There are companies that prefer to pay a higher price per item and have the exact amount they need as opposed to accepting an excessive MOQ, having problems storing the merchandise, and running the risk of it turning into dead stock.

MOQ: key in the customer-supplier relationship

The minimum order quantity is the starting point for any business relationship between a customer and a supplier. Obviously, suppliers have the upper hand, as MOQs ensure them financial gain and that they’ll cover their costs. MOQs can also benefit customers, though: they facilitate price comparisons, foster the customer-supplier relationship, and can even help to improve warehouse management (if you know there’s a minimum order quantity, inventory management is more predictable).